Baltic Private Equity and Venture Capital Market Overview 2020

Welcome to the Baltic PE / VC 2020 report!

Deloitte and the Baltic Private Equity and Venture Capital Associations are honoured to present the Private Equity and Venture Capital Market Overview 2020, which has been prepared by the parties for the second year running.

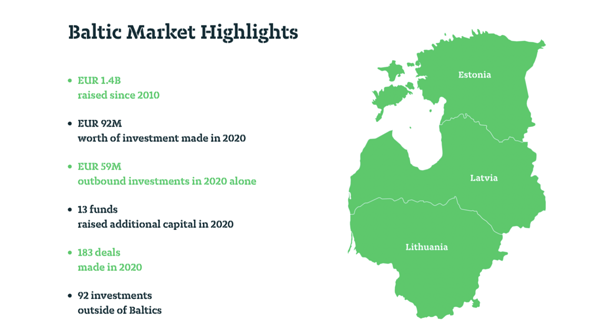

Despite being a relatively young market, the Baltic PE/VC industry has shown substantial growth and is again reaching record heights in its 2020 activities. Since 2010, the Baltic Private Equity and Venture Capital sector has demonstrated rapid growth, with EUR 1.4B of new capital raised. Following a record year in 2019 (EUR 490M raised), the pace of capital raising slowed in 2020, with EUR 138M raised during the year. As of the end of 2020, a significant portion of capital (EUR 766M) was still available for investments.

2020 can be characterised as a year of exits for the Baltic market, with 39 exits and a divestment value at cost of EUR 37M. Successful exits have also paved the way for subsequent fundraising activities, with 13 funds raising additional capital.

The performance of funds, as measured by the number and volume of investments, was also high, with EUR 92M worth of investments made, relating to 183 deals in 2020. This is a slight slow-down compared to 204 deals made in 2020 and a total value of EUR 204M.

Outbound investing also peaked in 2020. Out of a cumulative invested amount of EUR 106M during the 2010-2020 period, over half (EUR 59M) was made in 2020 alone. During this period, 92 investments outside of the Baltics were made, the majority of which concentrated on the Nordic countries and the UK.