BALTIC VCA

SUMMIT 2019

21–22 AUGUST, PÄRNU, ESTONIA

Each summer, at the end of August, Baltic Private Equity & Venture Capital professionals gather at one the beautiful Baltic resorts to discuss industry developments, network & enjoy various activities together. EstVCA has the pleasure of inviting you to the 8th edition of Baltic VCA Summit.

PÄRNU, ESTONIA

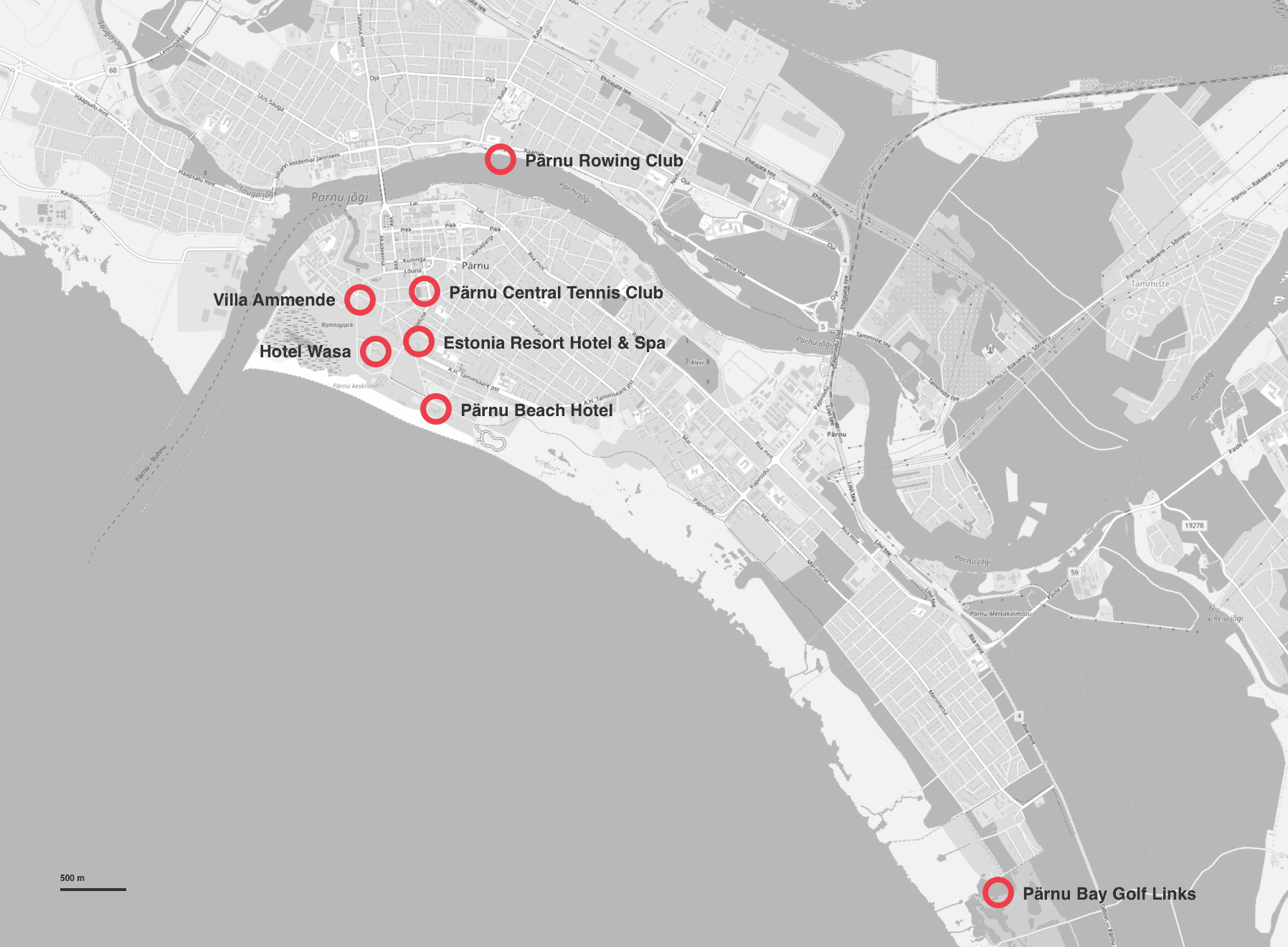

Baltic VCA Summit will be held on 21-22 August in Pärnu – a resort town known for its 19th-century timber villas and for sandy Pärnu Beach, with its shallow waters, and promenades.

The main event will be held on 21 August at the iconic Pärnu Beach Hotel. On 22 August Baltic VCA Summit will continue with a series of activities and will reach its finale at Pärnu Rowing Club with a thrilling race where VCs go up against Buyout.

DAY 1

Wednesday, 21 August 2019

12:00 - 13:00

Welcoming lunch

13:00 - 14:30

SESSION I

OPENING SPEECH:

Taavi Rõivas / Former Prime Minister of EstoniaTHE UNBELIEVABLE RISE OF BALTIC PE & VC:

Kristjan Kalda / Chairman at EstVCA

CRASH COURSE: Baltics & Finland

Kristiina Koort / Managing Director at EstVCA

Pia Santavirta / Managing Director at FVCA

BEHIND THE SCENES: Developing Finnish VC Industry

Matias Kaila / Director of Fund Investments at TESI

BALTICS: EBRD PERSPECTIVE ON THE PAST AND WHAT LIES AHEAD

Pavel Dvorak / Principal Banker at EBRD

14:30 - 15:00

Networking break

15:00 - 16:30

SESSION II

THE €70 BILLION LIMITED PARTNER PERSPECTIVE:

Ralph Guenther / Partner at Pantheon

Jesper Knutssøn / Partner at Saga Private Equity

Emma Honkanen / Associate at eQ

Tadas Gudaitis / CEO at Swedbank Investment Funds

Kriss Spulis / Senior Investment Manager at EIF

Kriss Spulis / Senior Investment Manager at EIF

INSIDE A CORPORATE VC:

Tomoko Inoue / CEO at Omron VenturesHELLO FROM EUROPE

Michael Collins / Chief Executive at Invest Europe

ASIAN OPPORTUNITY FOR EUROPEAN ENTREPRENEURS - CAN LP-s HELP TO BUILD THE BRIDGE?Chris Wade / Partner at Isomer Capital. Fireside chat with Margus Uudam

16:30 - 17:30

Closing remarks, drinks & refreshments

19:30 -

Dinner & evening programme by TGS Baltic

Dress code: Summer Cocktail AttireDid you know that

IT IS ACCEPTABLE TO NAP ON THE JOB IN JAPAN? IT’S VIEWeD AS EVIDENCE OF WORKING VERY HARD.

To keep the official part lively and entertaining, and to broaden the prospective of the audience, we add a specific country touch each year (previously Israel, India, Columbia, Netherlands).

This year the moderator will take the audience on a journey to Japan.

Insights into Japanese business and culture will continue throughout the day and evening programme.

CONFIRMED Speakers

Jerry Yang

General Partner at Hardware Club, Paris/Tokyo/SF

Moderator

Jerry Yang

General Partner at Hardware Club, Paris/Tokyo/SF

Jerry Yang is General Partner at

Hardware Club, a Paris-Silicon Valley-Tokyo based VC firm whose fund LPs include Foxconn,

Taizo Son’s Mistletoe, NGK Sparkplug, Digital Garage, Isomer Capital, Draper Esprit etc. And as a name suggests – it invests in

hardware startups. Before switching to the dark side, Jerry had been in analog

IC design for more than a decade.

Originally from Taiwan, Jerry's career has spanned across many continents and cultures. At a young age he won a large contract with Japanese electronics part manufacturer ROHM, which in turn it allowed him to exit his startup. Since then he has established a very strong connection with Japan and is closely familiar with Japanese corporate culture. He is also fluent in Japanese and is a routine speaker at VC and tech events, including Tech in Asia and SLUSH Tokyo.

Jerry has obtained a BS and MS degrees in

electrical engineering from the National Taiwan University and MBA degree from HEC Paris.

<

>

Close

Taavi Rõivas

Former Prime Minister of Estonia

Taavi Rõivas

Former Prime Minister of Estonia

<

>

Close

Chris Wade

Partner at Isomer Capital, London

Chris Wade

Partner at Isomer Capital, London

Chris is a Cofounder and Partner at Isomer Capital. He is on the board of technology companies Calastone, Machines with Vison and in 2016 Magic Pony Technologies that was acquired by Twitter. He was one the original advisors and Venture Partners at Entrepreneur First. Chris was the founding director of the Venture Capital Unit for the UK Government where he promoted the UK VC and direct investment opportunities to investors in the US and Asia and attracted over $1B, he also advised the Singaporean Government on European VC’s. In 1998 he co-founded CPS a mobile location tech company which he successfully sold in 2007 to a major global chip design company. Prior to his start up experience he had over 15 years operational experience at US based DSc which he assisted in the $4B sale to Alcatel and Northern Telecom where he worked in Turkey and the US. He has a BSc in Physics and Chemistry from Leeds University under an industrial scholarship program

<

>

Close

Jesper Knutssøn

Partner, Saga Private Equity, Copenhagen

Jesper Knutssøn

Partner, Saga Private Equity, Copenhagen

Jesper Knutssøn is partner and co-founder of Saga Private Equity. He has 28 years of experience in private equity and investment banking. At Saga Privat Equity he is responsible for investor relations and he has been involved in several due diligence processes. Previously, Jesper was responsible for investor relations at Danske Private Equity from 2006-2017. Before entering the private equity industry in 2006, he worked at Ixis Securities (Natixis) and Svenska Handelsbanken France. Mr. Knutssøn holds a M. Sc. (Economics) from the University of Copenhagen.

<

>

Close

Pia Santavirta

Managing Director at FVCA, Helsinki

Pia Santavirta

Managing Director at FVCA, Helsinki

<

>

Close

Michael Collins

Chief Executive at Invest Europe, Brussels

Michael Collins

Chief Executive at Invest Europe, Brussels

Michael represents the industry at the highest levels of business and

government and is a regular commentator in the international media. He

joined Invest Europe in 2013 from Citigroup, where he was Managing

Director for European Government Affairs. Michael was previously at the

UK Permanent Representation to the EU and has 15 years of experience in

the UK civil service.

<

>

Close

Tomoko Inoue

CEO at Omron Ventures, Tokyo

Tomoko Inoue

CEO at Omron Ventures, Tokyo

<

>

Close

Matias Kaila

Director, Fund Investments at TESI, Helsinki

Matias Kaila

Director, Fund Investments at TESI, Helsinki

Tesi is a Finnish state-owned investment company that accelerates growth companies’ success stories by investing in them, both directly and via funds. Tesi is a major player in the Finnish private equity market with AUM of €1.3bn. Tesi invests in all sectors on equal terms and always together with private investors. The mission of Tesi is to develop Finnish venture capital and private equity market as well as to promote economic and business growth in Finland.

<

>

Close

Kristiina Koort

Managing Director at EstVCA, Tallinn

Kristiina Koort

Managing Director at EstVCA, Tallinn

<

>

Close

Tadas Gudaitis

CEO at Swedbank Asset Management, Vilnius

Tadas Gudaitis

CEO at Swedbank Asset Management, Vilnius

Tadas has 15+ years of experience in life insurance and asset management area and currently leading the largest pension funds’ management company in Lithuania. He is member of the Management Board at Lithuanian Private Equity and Venture Capital Association and Review Board Member at Baltic Financial Advisors Association. In 2010 he defended PhD thesis in Economics at Vilnius University.

<

>

Close

Ralph Guenther

Partner at Pantheon, London

Ralph Guenther

Partner at Pantheon, London

Ralph is a member of Pantheon’s European Investor Relations team, focusing on Germany, Austria and Switzerland, and will also source deals for Pantheon’s secondaries team. Ralph was previously a Managing Director with bmp AG where he worked on private equity fund-of-funds and advisory services for institutional clients. He has a degree in economics from FU Berlin.

Pantheon is one of the largest Private Equity houses in the world offering primary, secondary and co-investment strategies across private equity, infrastructure and real assets. Headquartered in London and with offices in New York, San Francisco, Hong Kong, Seoul, Bogotá and Dublin. Pantheon's AUM is 43,5bn USD.

<

>

Close

Kristjan Kalda

Partner at BaltCap, Tallinn

Kristjan Kalda

Partner at BaltCap, Tallinn

<

>

Close

Kriss Spulis

Investment Manager at EIF, Luxembourg

Kriss Spulis

Investment Manager at EIF, Luxembourg

Kriss is a senior investment manager in EIF’s earlystage VC and BA fund-of-funds practice, former business angel, entrepreneur and management consultant. Kriss has a "hands-on" experience in co-founding and developing businesses in product and service sectors, advisory work, as well as investing himself as a business angel. Kriss holds an MBA degree from INSEAD (Singapore, France).

<

>

Close

Pavel Dvorak

Principal Banker at EBRD, London

Pavel Dvorak

Principal Banker at EBRD, London

<

>

Close

DAY 2

07:30 - 08:30 KARMA RUN

Those who enjoy getting up really early can join Karma Ventures team for a 10k karma run and explore the city of Pärnu.

10:30 - 12:00 CYCLING

A relaxed guided cycling tour around Pärnu. Pedaling through the charming old town, beach parks and promenades,

passing coastal meadow hiking trail, watching urban cows and making a few wine stops on the way.

10:30 - 12:30 TENNIS

Tennis lovers can join for a small tournament at the Pärnu City Tennis Club.

10:30 - 12:30 GOLF

Those into golf can enjoy one of the finest courses in Northern Europe - Pärnu Bay Golf Links.

13:00 - 17:00

BALTCAP PRESENTS:

BBQ & Baltic VCA Rowing RegattA

The city of Pärnu is strongly associated with its surrounding water, both the Baltic Sea and

Pärnu River. Next to this, rowing is the most prominent sport and has brought the city

of Pärnu many Olympic medals and international fame.

At 13:00 we will gather at Pärnu Rowing Club for a barbecue by the one and only Enn Tobreluts, followed by cocktails and a lots of entertainment. Those interested, can try rowing on Pärnu river with instructors.

Baltic VCA summit will be concluded by a thrilling boat race where VC-s, Buyout, LP-s and service providers will go up against each other in a boats designed for 8 rowers. You can think of it as a Harvard-Yale Regatta but for Baltic PE & VC professionals.

Accommodation

We have pre-bookings until July in the following hotels. Ask for a discount with the codeword “VCSummit”